SALONI SURI, Shareholder Analytics

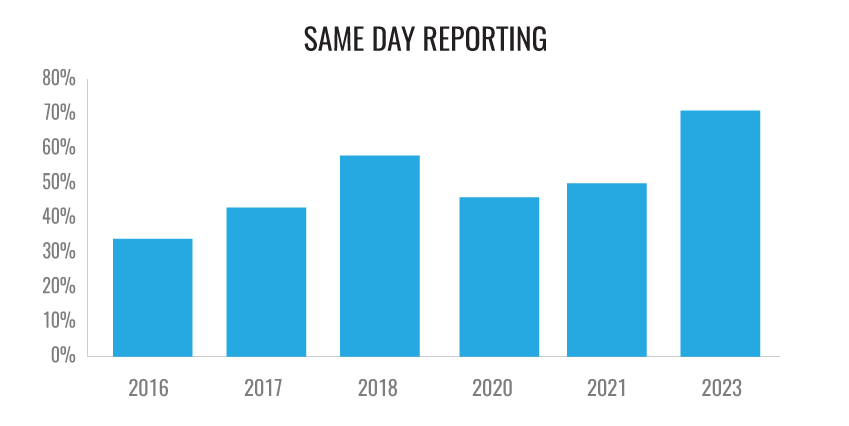

For several years, First Advisers has been tracking trends in Same Day Reporting by ASX300 companies, which we define as releasing an Annual Report and Financial Results on the same day. The practice of providing an Annual Report on the same day as a companies’ results has become a KPI for investor relations over the past 5 years and is now generally considered best practice.

As we reported in our August newsletter, 71% of ASX300 companies provided an annual report on the same day that they released their Financial Results in 2023, the highest number since FIRST Advisers started tracking the data in 2016.

After reaching a peak of 58% in 2018, the onset of COVID in early 2020 not only disrupted our Same Day Reporting data collection but also impacted the ability of many listed companies to meet this standard. In 2020 only 46% of ASX300 companies were Same Day Reporting, a figure that improved only slightly in 2021.

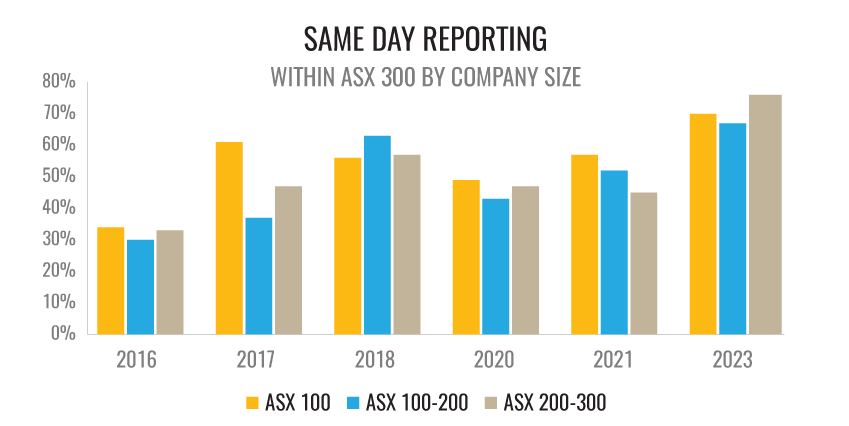

Does size matter?

In 2023, the increased adoption of Same Day Reporting can be observed regardless of size as the following analysis demonstrates:

- ASX100 companies – 70% compared to 57% in 2021 and 56% in 2018

- ASX100-200 – 67% compared to 52% in 2021 and 63% in 2018

- ASX 200-300 – 76% compared to 45% in 2021 and 57% in 2018

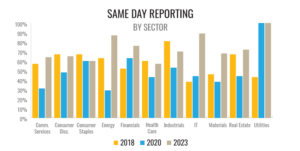

Which sectors lead the way…

Our findings show that Utilities (100%), Information Technology (89%) and Energy (87%) are strong adopters of Same Day reporting. The sectors that showed the strongest improvement were Communication Services, 64% from 36% in 2021, followed by Real Estate sector 72% from 44% in 2021.

…or are struggling to return to previous form

Four sectors failed to match the pre-Covid peak levels seen in 2018. These include the Consumer Discretionary (65% vs 67%), Consumer Staples (60% vs 67%), Industrials (70% vs 81%) and Health Care (57% vs 60%). The 57% of companies in Health Care that adopted Same Day Reporting is not only below the 2018 peak but only just matched 2017.

The majority now publish their Annual Report within one week of their results

The push to release on the same day as results, as would be expected, saw less than a handful of annual reports being published in the following week. As a result, 72% of companies this year released in the first week of reporting their results, up from 52% in 2021. This was accompanied by a significant reduction in companies publishing their Annual Reports 5-8 weeks (20%) after their full year results (cf 38% in 2021). We also observed that while there is a steady release of annual reports each week up until the statutory deadline of 3 months after balance date, there is spike in the fifth week, most likely aligned with the mailout of Notices of Meeting for the AGM.

Conclusion

As the most disruptive aspects of the COVID19 pandemic are consigned to history we are seeing a return to an upward trend in the number of companies adopting the best practice standard of Same Day Reporting at every level in the ASX300. Most sectors are now ahead of the prior Same Day Reporting peak of 2018, with only Consumer Discretionary, Consumer Staples, Industrials and Health Care yet to exceed pre-COVID levels. Our expectation for future reporting cycles is, in the absence of any new and significant disruption to the normal functioning of Investor relations teams, the momentum we are seeing will drive all sectors to exceed the 2018 peaks for Same Day Reporting.