GILES RAFFERTY, Corporate Communications and Media Adviser

The COVID-19 pandemic effectively eliminated in person Investor Relations (IR) meetings and events and accelerated the adoption and refinement of virtual interactions between companies and the investment community. Now, with travel restrictions removed or significantly eased and the WHO reporting global COVID cases falling 9% and deaths 15%, we are looking at what the new norm for corporate access may look like.

The majority of direct interactions between a company and their investors take place across Roadshows, Investor Days, Site Visits and Conferences.

- Roadshow: An intensive series of one-on-one meetings with shareholders, brokers and potential investors where a CEO, CFO and/or IRO give updates on a company’s performance and future goals.

- Investor Day: A meeting where senior management give detailed presentations on relevant topics and issues of the day to an audience of analysts, shareholders and prospective investors

- Site Visit: Investors visit a company’s headquarters, operations and/or facilities and gain exposure to multiple layers of management and employees, tour the site and observe the operations

- Conferences: An event involving multiple companies and investors with simultaneous presentations, workshops and networking opportunities to build a company’s profile and relationship with investors

Domestic investor events

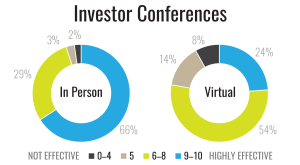

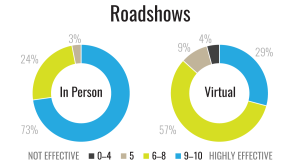

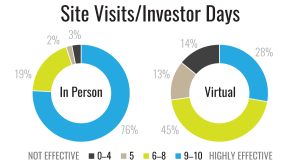

A review of data contained in the IR Magazine Corporate Access report – part 2 released in June 2022 indicates that at least 95% of IRO’s give a positive rating of at least 6 out of 10 to in person investor events in their home market.

In-person investor conferences are rated as highly effective, or given over 9 out of 10, by two thirds of IROs, with in-person investor roadshows seen as highly effective by almost three quarters of IROs, while 76% of IRO’s say in-person site visits and investor days are highly effective. By contrast the virtual equivalents of these events are more lowly rated, with less than 3 out of 10 IRO’s scoring virtual roadshows, site visits and investors days at 9 out of 10 or above and less than a quarter scoring virtual investor conferences at over 9 out of 10. See figure 1.

Figure 1

To what extent do you find the following formats of engagement effective?

Taking a Meeting

The effectiveness ascribed to in-person events by IRO’s seems at odds with the overall finding that only slightly more investors are likely to take a meeting if it is in person rather than virtual, revealed by the IR magazine’s Corporate Access Report – part 1 sponsored by Q4.

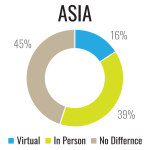

35 percent say they are more likely to take an in-person meeting, compared with 31 percent that are more likely to take a virtual meeting and just over a third of respondents said that it makes no difference. A deeper dive into these findings reveals they are skewed by the majority, at 39%, of North American investors being more inclined to take virtual meetings post COVID lockdowns, while the majority in Europe, at 43%, prefer in-person and in Asia, including Australia, 39%, prefer in-person meetings compared to only 16% who prefer virtual, with the majority saying it makes no difference. See figure 2.

Figure 2

Does a virtual or in-person format affect how likely you are to take a meeting?

Site Tour Practices

We can take a closer look at the Australasian region through research from the Australasian Investor relations Association (AIRA) into listed entities site visit practices published in July 2022. The research reveals that 84% of respondents will provide in-person only investor site visits/events. See Figure 3. In total 48 listed entities participated in this AIRA snap poll, and while it does not represent a comprehensive review of the four main corporate access events, it does indicate in-person interactions are seen as adding value.

Figure 3

In what format will you or did you offer the site tour?

| In-Person | Virtual | Other | ||

|---|---|---|---|---|

| All Respondents | 84% | 0% | 16% | |

| ASX 100 | 84% | 0% | 16% | |

| Ex-100 Companies | 83% | 0% | 17% | |

| Financials Sector | 25% | 0% | 75% | |

| REITS Sector | 83% | 0% | 17% | |

| Industrials Sector | 90% | 0% | 10% |

Other includes: in-person with a virtual option, or with video/presentation on a delayed basis.

Adapting to the new norm

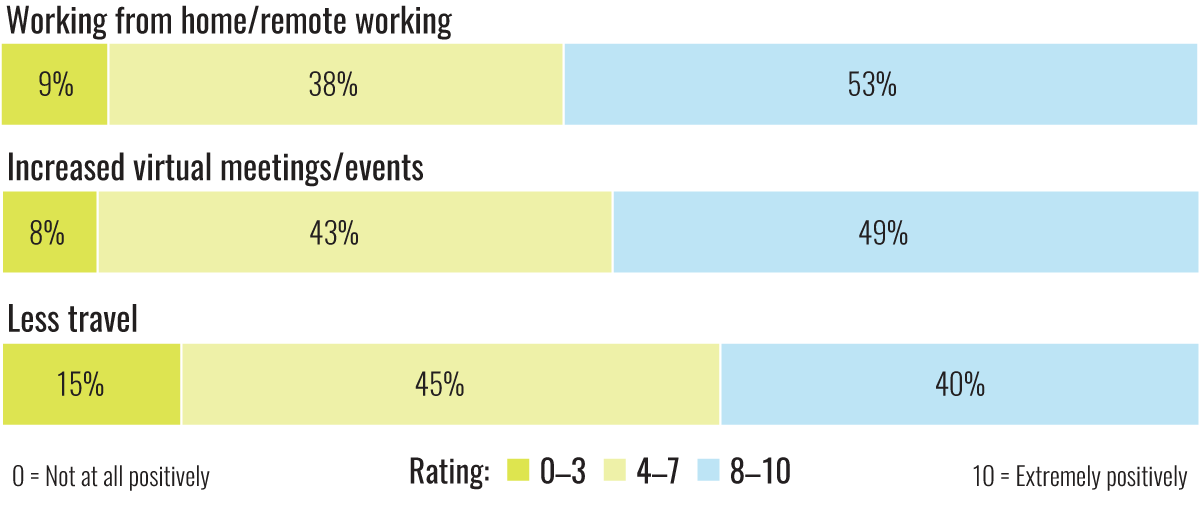

COVID-19 has fundamentally changed working practices. For the past two years we have learned to adapt to home/remote working, increased virtual meetings/events and less travel. Now that we have the option to return to the office, to hold in-person meetings and with travel restrictions eased these changes to work are still seen as a positive.

On a scale of zero to 10 where zero is not at all positively and 10 is extremely positively, more than half of respondents to IR Magazine’s COVID 19 Update 2022 give a high rating of eight or above to working from home/remote working. At the same time, just under half give a similar rating to increased virtual meetings/events. Less travel is viewed comparatively less positively, with four in 10 giving a high rating of eight or more. See Figure 4.

Figure 4

How do you personally view COVID-19 related changes to working practices?

Despite the adoption of working practices designed to manage COVID as the new normal, it appears that when it comes to corporate access a return to in-person activities, at least across Australia, Asia and Europe, is seen as adding greater value.