SALONI SURI, Shareholder Analytics and Investor Relations

Australia’s new mandatory climate reporting regime came into force from the start of this year. As it is rolled out, listed and private companies, alongside financial institutions, will need to disclose information about their climate-related risks and opportunities in a ‘Sustainability Report’.

For the year commencing 1 January 2025 only the largest entities are required to report but the legislation will extend to a broader range of entities over 2026 and into 2027, (see Table 1 below).

| Requirement | Group 1 First annual reporting periods starting on or after 1 Jan 2025 | Group 2 First annual reporting periods starting on or after 1 Jul 2026 | Group 3 First annual reporting periods starting on or after 1 Jul 2027 |

|---|---|---|---|

| Entities meeting at least two of three criteria | Consolidated revenue: $500 million or more | Consolidated revenue: $200 million or more | Consolidated revenue: $50 million or more |

| EOFY consolidated gross assets: $1 billion or more | EOFY consolidated gross assets: $500 million or more | EOFY consolidated gross assets: $25 million or more |

|

| EOFY Employees: 500 or more | EOFY Employees: 250 or more | EOFY Employees: 100 or more |

|

Table 1: Thresholds and timing for Mandatory climate-related financial disclosures

FIRST Advisers has been tracking the performance of Australia’s top listed companies on Environmental, Social and Governance (ESG) reporting for several years. To get a sense of how well placed Australian companies are for the new mandatory climate reporting regime we have conducted a review of ESG reporting in 2024 to highlight what’s changed since our 2023 review.

We focused on companies within the S&P/ASX300, segmented by market cap into Large-Cap (S&P/ASX100), Mid-Cap (S&P/ASX101-200), and Small-Cap companies (S&P/ASX201-300).

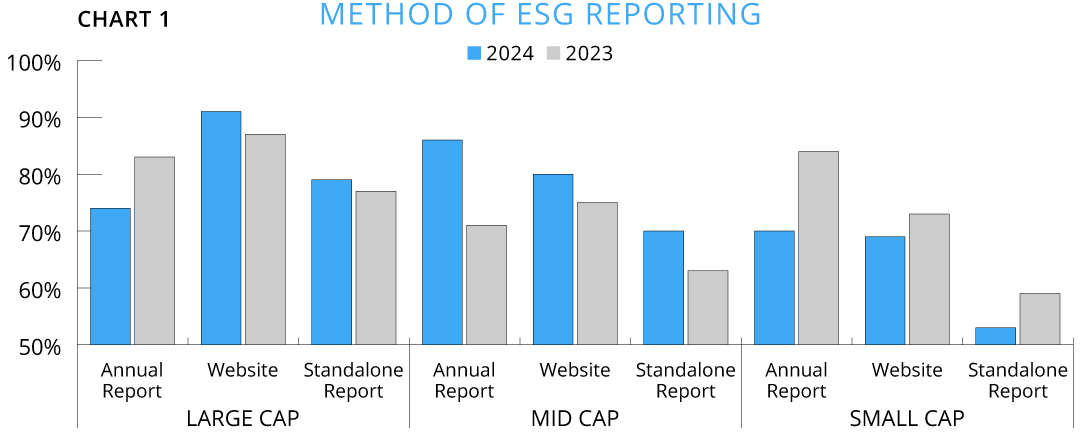

Preferred Methods of Disclosure

Our review includes an analysis of how ASX300 companies choose to report on ESG. We looked at three reporting channels – an ESG section in a company’s Annual report, ESG disclosure section on a company’s website and production of a standalone ESG/Sustainability report, (see Chart 1 – Method of Reporting below). We note that in 2024 it was very common for companies to adopt more than one reporting method with 52% of large caps in the ASX300 reporting across all three channels. 59% of Mid-Cap and 44% of Small-Cap companies also reported via all three methods.

A breakdown of preferred ESG reporting in 2024 revealed 80% of ASX 300 companies include a Sustainability section on their website, matching the preference to include ESG reporting within the Annual Report (78%). The average number of Australian companies electing to produce a standalone report was 67% in 2024, (same as 2023). 9% of the ASX300 companies did not report ESG via any method.

The number of large cap Australian companies producing a standalone report (79%) has increased from 77% in 2023. This trend was same for mid cap companies (70%) in 2024, compared to 63% in 2023, whereas the number of small cap companies producing a standalone report decreased to 53% in 2024 (59% in 2023).

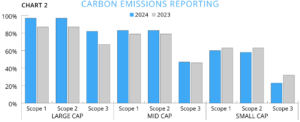

The adoption of Scope 1, 2 and 3 metrics

The new climate reporting regime requires disclosures in line with AASB S2, Australia’s mandatory standard for climate-related disclosures. AASB S2, is based on the international sustainability standard IFRS S2 and incorporates and builds on the framework of the Task Force on Climate-related Financial Disclosures (TCFD). AASB S2 requires more detailed and quantitative disclosures of the current and anticipated financial impacts of climate change over the short, medium, and long term. It also requires disclosures on metrics and targets, including scope 1 and 2 carbon emissions, from the commencement of mandatory climate reporting, and scope 3 emissions from the second reporting year onwards (see Chart 2 – Carbon Emissions Reporting).

Scope 1 emissions are those generated from sources that the company owns or controls directly while Scope 2 emissions are indirect emissions that are a consequence of a company’s activities but occur from sources not owned or controlled by it, such as electricity usage. Scope 3 emissions include all sources not captured by Scope 1 and 2 that are created in a company’s value chain.

The requirement for companies to report on their carbon emissions is causing the greatest impost in terms of data gathering, particularly Scope 3.

The analysis of Scope 1 and 2 emissions reporting in 2024 reveals 97% of Australia’s Large-Cap and 83% of Mid-Cap companies are comfortably reporting on these. 58-60% of Australian Small caps reported both the scopes (compared to 63% in 2023).

Reporting on Scope 3 emissions is more challenging. During 2024, 82% of Australian Large caps are addressing Scope 3 reporting (67% in 2023). 47% of Mid cap and only 23% of Small-Cap companies reported Scope 3 in 2024.

Conclusion

While some level of ESG reporting has become mainstream in Australia’s ASX 300 companies, in many cases there is more work to do to comply with Australia’s new mandatory climate reporting regime. At FIRST Advisers, we have been advising our clients on best practice Sustainability reporting for a number of years. Over that time, we identified that there are challenges around gathering Scope 1, 2 and particularly 3 carbon emissions and forged a partnership with Netnada to address this. We can now offer clients access to actionable tools and insights to help them with measuring and reducing their carbon footprint. Contact us for further information on admin@firstadvisers.com.au.