SALONI SURI, Shareholder Analytics.

After several lean years for new listings, 2025 delivered a late‑cycle surge in IPO activity on the ASX, but with a very different profile to the pre‑pandemic boom. The market was dominated by smaller resources and real‑asset names, punctuated by a handful of very large transactions.

Overall, there were 37 IPOs* that, combined, were valued at around $15 billion. Almost half of this total, or $7.2 billion can attributed to the 2 largest listings – Virgin Australia Holdings, which raised $685 million for a market capitalisation of $2.3 billion and Greatland Resources, which raised $490 million for a market capitalisation of $4.9 billion. If we strip out the distorting influence of these two big beasts, the median market cap for the remaining 35 floats comes in at around $223 million.

When did IPOs list?

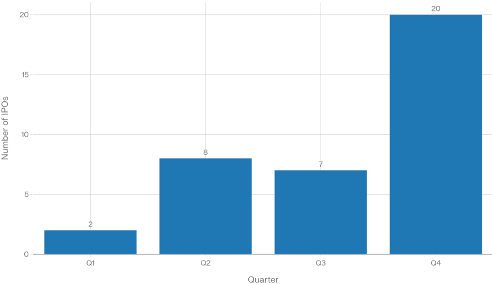

20, or more than half, of the 2025 IPOs listed in the December quarter, compared to 17 across Q1–Q3. This illustrates how IPO momentum build built towards a very busy end‑of‑year, even though the biggest single floats got away in Q2 and Q4.

2025 IPOs by quarter

The quarterly breakdown reveals:

-

- Q1 – 2 IPOs, both investment trusts, with combined market cap of roughly A$632 million

- Q2 – 8 IPOs, including Virgin Australia Holdings, Greatland Resources, with combined market cap of roughly A$7.5 billion

- Q3 – 7 IPOs, mainly mid‑cap resources and real‑asset names such as Ballard Mining and Gemlife Communities Group, with combined market cap of roughly A$1.9 billion

- Q4 – 20 IPOs, dominated by smaller resources, environmental and industrial companies, with combined market cap of roughly A$5.1 billion

What sectors led the way?

Materials and related sectors were the backbone of the 2025 IPO market, but with a broader mix of real assets and income vehicles layered on top. The key sector themes were:

-

- Precious Metals – 14 IPOs with an aggregate market cap in excess of A$6 billion, making it the most active sector. Listing included Greatland Resources, Ballard Mining, Black Horse Mining, Sentinel Metals, PC Gold, Golden Dragon Mining, Green & Gold Minerals

- Other Metals/Minerals – 6 IPOs, including Equus Energy, Tali Resources, BMC Minerals, Exultant Mining and Vbx, for a total market cap of roughly A$900 million

- Investment Trusts/Mutual Funds – 3 IPOs – Dominion Income Trust 1, Ma Credit Income Trust and WAM Income Maximiser – with a combined IPO market cap just under A$790 million

- Real assets and infrastructure – 3 IPOs which included the high profile Virgin Australia IPO alongside Gemlife Communities Group (Real Estate) and Sea Forest (Agricultural Commodities/Milling)

- Healthcare, technology and sustainability – 7 IPOs including Saluda Medical and Tetratherix (Medical Specialties), Epi‑Minder (Electronic Equipment/Instruments), StepChange Holdings (IT Services), Infragreen Group (Environmental Services) and Advanced Innergy Holdings (Industrial Specialties)

This sector mix continues the long‑running trend seen in earlier years – mining and energy names dominate the new‑listings pipeline by number, while a much smaller group of industrial, financial and infrastructure names shape the overall dollars raised.

Top 10 IPO performers 2025 – since listing

| Company | % change (to 31 Dec) | Listing date | Market cap (A$m) | Sector |

|---|---|---|---|---|

| Ballard Mining (ASX:BM1) | +178% | 14 Jul | 126 | Precious Metals |

| Sentinel Metals (ASX:SNM) | +110% | 30 Oct | 32 | Precious Metals |

| Black Horse Mining (ASX:BHL) | +105% | 2 Dec | 23 | Precious Metals |

| Everlast Minerals (ASX:EV8) | +103% | 23 Sep | 41 | Construction Materials |

| Robex Resources (ASX:RXR) | +83% | 5 Jun | 726 | Precious Metals |

| Orezone Gold Corp (ASX:ORE) | +68% | 8 Aug | 688 | Precious Metals |

| Tali Resources (ASX:TR2) | +65% | 18 Jul | 44 | Other Metals/Minerals |

| Greatland Resources (ASX:GCP) | +59% | 24 Jun | 4,900 | Precious Metals |

| Equus Energy (ASX:EQU) | +58% | 18 Dec | 29 | Other Metals/Minerals |

| PC Gold (ASX:PC2) | +42% | 21 Oct | 80 | Precious Metals |

The winners’ list is strikingly concentrated in resources, particularly gold and other precious metals, where small‑cap miners provided much of the upside for IPO investors willing to take exploration risk.

Bottom 10 IPO performers 2025 – since listing

| Company | % change (to 31 Dec) | Listing date | Market cap (A$m) | Sector |

|---|---|---|---|---|

| Saluda Medical (ASX:SLD) | −46% | 5 Dec | 320.1 | Medical Specialties |

| Epi‑Minder (ASX:EPI) | −32% | 1 Dec | 283.8 | Electronic Equipment/Instruments |

| Carma (ASX:CMA) | −30% | 5 Nov | 341.7 | Miscellaneous |

| StepChange Holdings (ASX:STH) | −30% | 10 Jul | 32.0 | Information Technology |

| Infragreen Group (ASX:IFN) | −24% | 25 Jun | 246.3 | Environmental Services |

| Nexsen (ASX:NXN) | −20% | 14 Oct | 56.1 | Biotechnology |

| Moonlight Resources (ASX:ML8) | −18% | 11 Dec | 15.5 | Precious Metals |

| Green & Gold Minerals (ASX:GG1) | −5% | 8 Oct | 18.6 | Precious Metals |

| Advanced Innergy Holdings (ASX:AIH) | −4% | 31 Oct | 405.4 | Industrial Specialties |

| Ma Credit Income Trust (ASX:MA1) | −0.25% | 5 Mar | 330.5 | Investment Trusts/Mutual Funds |

The 2025 underperformers are spread across medical devices, technology, clean‑tech and some speculative resources, highlighting that investors have become more discriminating outside the core mining theme.

Summary

Looking across the 2025 scorecard, three themes stand out.

Late‑year window remains critical

More than half of the year’s IPOs landed in the last quarter, repeating the pattern seen in 2020 as issuers waited for greater macro‑clarity and stronger risk appetite before coming to market. For companies contemplating a float, the message is that the practical IPO window often narrows to a few busy months, rather than being open year‑round.

Resources still dominate by count and, often, by performance

Metals and mining names once again constituted the majority of listings, and they also supplied most of the year’s strongest price performers. While this is not new for the ASX, it reinforces the idea that investors continue to use IPOs to access early‑stage resource stories rather than established industrial businesses.

Selected large cap and real‑asset IPOs can still cut through

Deals such as Virgin Australia, Gemlife Communities and the larger precious‑metals names show that when a recognisable story with scale comes to market, there is still deep demand – even in a cautious environment. However, outside these marquee names, many smaller non‑resources IPOs struggled to gain traction in the secondary market, as shown by the underperformance of Saluda Medical, Epi‑Minder and several sustainability‑themed offerings.

For companies considering an IPO or secondary raising in the coming year, the 2025 final scorecard tells a familiar story: timing, sector, size and post capital raising execution all matter, but in a market still anchored to resources, non‑resources issuers will need a particularly clear equity story to stand out.

* IPO data for the period 01 January 2025 to 31 December 2025 sourced from FactSet.