GILES RAFFERTY, Corporate Communication and Media Advisor

An analysis of data collected by Proxy Advisory firm Glass Lewis on voting outcomes during the 2023 Australian AGM season reveals a record number of companies received strikes against their remuneration reports, there was a significant increase in the number and severity of dissenting votes against Directors and less of a focus on ‘Say on Climate’ resolutions.

For 2024, the team at Glass Lewis have called out cybersecurity and the rise in the use of artificial intelligence as likely to make technology-related oversight by Boards a key concern for investors, alongside management of macro risks, especially the impacts from geopolitics and economic fluctuations.

While Board composition and effectiveness, CEO pay and ESG related issues, such as Human Capital Management and Climate Change, will continue to be in investors cross hairs.

Remuneration Strikes

The 2023 AGM season in Australia set a record with 40 S&P/ASX300 companies receiving strikes on their remuneration reports, the highest since the introduction of the two-strike rule in 2011. This represents a marked departure from the range of 22 to 26 strikes observed between 2019-2022 inclusive, with 22 strikes recorded in 2022. In addition, there were 24 companies who received votes against their remuneration reports that exceed 40% compared to 5 in 2022.

The Glass Lewis data indicated the following themes as drivers of the 2023 strikes:

-

- The perceived preferential treatment of executives, particularly in the context of poor shareholder returns, e.g. misaligned retention awards, generous incentive outcomes, and the board’s exercise of upward discretion.

- Insufficient disclosure regarding performance assessments and targets underpinning incentive outcomes.

- Poorly designed, underdeveloped, or discretionary remuneration structures, including LTI plans that feature one-year performance periods rather than promoting long-term objectives.

- Concerns the elimination of market-based metrics from incentive schemes reduced alignment with shareholder interests.

- Objections to generous remuneration packages involving increases in fixed pay or incentive opportunities.

- Variable incentive outcomes that failed to meaningfully reflect poor safety outcomes.

- Dissatisfaction with the emergence of headline risk and damage to the corporate reputation.

Glass Lewis’ pay-for-performance analysis suggests that CEO and executive pay growth is slowing, in part due to declines in incentive payments. This analysis, however, highlights CEO retention bonuses as part of succession planning, or lack thereof, as a potential area for concern to be monitored as a source of additional costs to shareholders during 2024.

Election of Directors

A notable shift during the 2023 AGM season was shareholders increasingly voicing their dissatisfaction with subpar company performance by voting against remuneration reports and challenging directors during re-elections.

2023 saw 29 substantial protest votes against director nominees at ASX300 companies, a notable increase from 13 in 2022 and 16 in 2021. Of these 29 votes, four were external candidates not endorsed by the board, in contrast to one in 2022 and six in 2021. The remaining 25 dissenting votes were against board-endorsed director candidates, compared to 12 in 2022 and 10 in 2021.

Some of the drivers of the protest votes were:

-

- Shareholder discontent with lagging share prices or operational concerns. Holding directors accountable for below-average performance has become a leading cause of shareholder dissent, marking a significant shift from historical patterns.

- Dubious remuneration practices which are not only being challenged through proposals directly related to pay, but also by voting against directors who oversee remuneration.

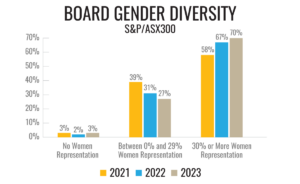

- A perceived lack of gender diversity on the board. The average female representation on S&P/ASX300 boards continues to increase, (see figure 1), and shareholders challenging companies that are falling behind in this area.

- Concerns over the level of Director independence and overcommitment.

- Controversies linked to Directors.

The Glass Lewis data also shows protest votes against Directors linked to concerns around retention awards, overly generous incentive outcomes, lack of transparency and a focus on short-term gains in incentive structures.

Scrutiny of Board Effectiveness

As we move through 2024, technology risks associated with cybersecurity and artificial Intelligence are expected to be front and centre for both Boards and investors. Emerging concerns around AI ethics, which may have been seen as specific to big tech, will likely expand in 2024 into additional sectors such as Healthcare and Credit Rating providers.

Glass Lewis has also noted an increase in investor and stakeholder interest around board oversight and management of macro risks, with a focus on geopolitical risk and associated economic and supply chain disruption.

A hallmark of an effective Board is a diversity of thought, which can be a function of Board composition. It is expected there will continue to be close scrutiny of the diversity of skills, gender and racial/ethnic diversity of Boards. In response, more companies are expected to compile Board skills matrices alongside other disclosures that can provide insight into board effectiveness.

Companies seen as laggards in terms of Board diversity, risk oversight and related disclosure are likely to face heightened shareholder opposition in 2024.

ESG Shareholder Proposals

While ESG considerations continue to be a key focus for many investors, 2023 showed significantly less activity in terms of shareholder proposals and ‘Say on Climate’ resolutions.

That said, the persistent cost of living crisis may well see issues around human capital management, such as worker pay, sick leave, diversity and safety become significant themes for shareholders and possibly activists in 2024.

Despite a decline in ‘Say on Climate’ resolutions in 2023, Climate Change remains a significant and evolving issue. It is expected that during 2024 shareholder proposals focussing on climate change will also evolve and reflect the specific climate impact of different companies and sectors.